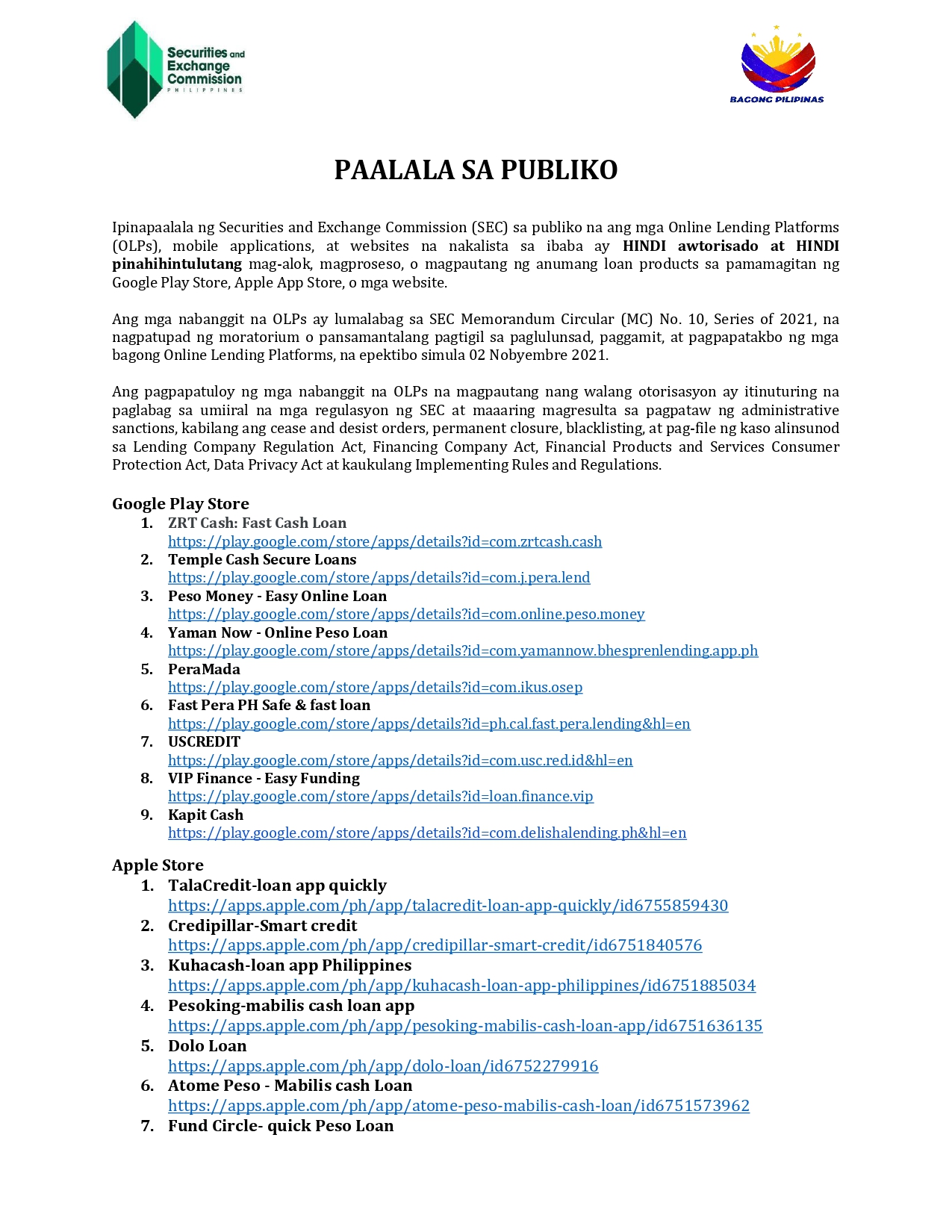

Securities and Exchange Commission has issued a fresh warning to the public about unauthorized online lending platforms that continue to operate in the Philippines, despite a long-standing regulatory moratorium.

In an official advisory, the SEC said several online loan apps and websites found on Google Play Store, Apple App Store, and independent websites are not recorded or authorized to offer loans. This means any loan processed through these platforms is illegal under Philippine law.

Contents

Why the SEC Issued This Warning

The advisory is anchored on SEC Memorandum Circular No. 10, Series of 2021, which placed a moratorium on new online lending platforms starting November 2, 2021. Only companies that were already registered and properly recorded before the moratorium are allowed to operate.

According to the SEC, platforms that ignore this rule may face serious penalties, including:

- Cease and Desist Orders

- Permanent closure and blacklisting

- Administrative fines

- Criminal or civil cases under lending and consumer protection laws

- Possible violations of the Data Privacy Act for misuse of personal data

This warning is part of the SEC’s ongoing crackdown on illegal digital lenders, many of which have been linked to harassment, data abuse, and unfair collection practices.

Apps and Websites Flagged by the SEC

The advisory lists multiple unregistered platforms, including:

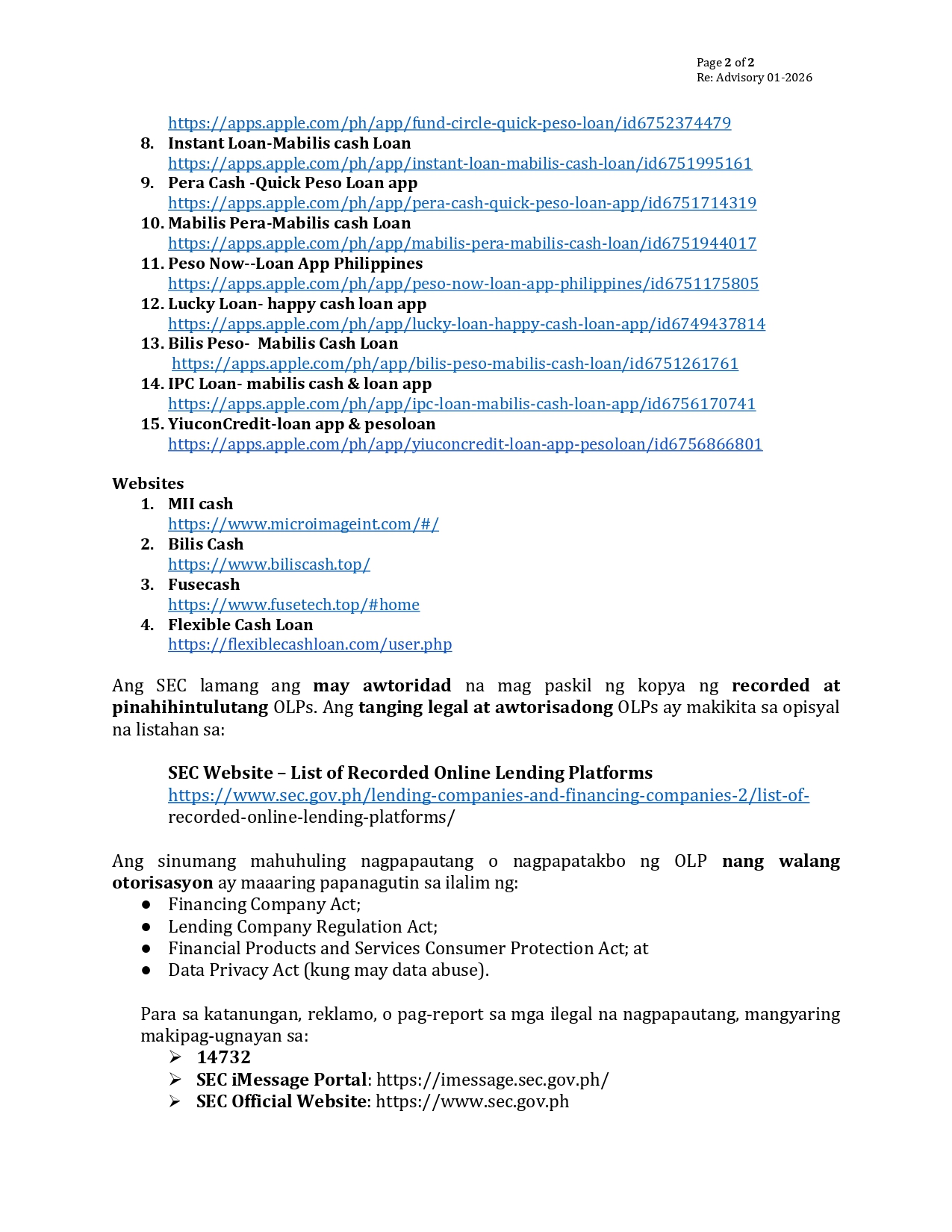

On Google Play Store

- ZRT Cash

- Temple Cash Secure Loans

- Peso Money

- Yaman Now

- PeraMada

On Apple App Store

- TalaCredit

- Credipillar

- Kuhacash

- Pesoking

- Dolo Loan

Web-based platforms

- MII Cash (microimageint.com)

- Bilis Cash (biliscash.top)

- Fusecash (fusetech.top)

- Flexible Cash Loan (flexiblecashloan.com)

The SEC stressed that the presence of an app on major app stores does not mean it is legal or approved. For a complete list of SEC-recognized online lending apps, you may visit the List of Recorded Online Lending Platforms.

How to Check if a Lending App Is Legit

The SEC reminds the public that only the commission can publish the official list of authorized online lending platforms. Borrowers are advised to verify lenders through the SEC’s official website before applying for any loan.

If you encounter an illegal lender, you can report it through:

- SEC Hotline: 14732

- SEC iMessage Portal

- Official SEC website

If a loan app is not on the SEC’s official list, avoid it. Using illegal platforms puts borrowers at risk of harassment, hidden fees, and data misuse. When in doubt, check first or report the app.