GCash Overseas provides an important financial service for Filipinos residing in the UAE, allowing them to seamlessly connect with banking services back in the Philippines.

This service is significant for the over 81 million active users who rely on the app, facilitating tasks such as remitting money, paying bills, and managing school fees.

Targeted primarily at Filipino expats, the service requires users to register using a UAE SIM card, ensuring transactions are both smooth and secure.

With the recent legislative push in the Philippines towards digitalization and financial security—highlighted by the introduction of bills like the Anti-Financial Scamming Act and the Anti-Mule and Financial Fraud Act—GCash Overseas also guarantees enhanced security and compliance, reinforcing its commitment to protect its users in an increasingly digital world.

Contents

Significance of the Service

Gcash Registration in the UAE holds immense significance, bridging financial services for Filipinos living abroad with their home country.

In the Philippines, GCash has emerged as a market leader in financial technology, serving over 81 million active users.

The recent international expansion of the fintech app to 16 countries, including the UAE, enables Filipinos in the UAE to manage their finances seamlessly and support their families back home.

By registering using a UAE SIM card, they can conveniently remit money, pay bills, taxes, and send school and college fees to their loved ones in the Philippines.

The proposed legislation, including the Anti-Financial Scamming Act (House Bill 7393) and the Anti-Mule and Financial Fraud Act of 2023 (Senate Bill 2039), plays a major role in combating cybercrimes.

These bills aim to penalize not only scammers but also their accomplices, known as money mules, who facilitate illicit transactions and obscure the source of funds.

By urgently passing and implementing these measures, the Philippines accelerates its digitalization and financial inclusion agenda.

GCash actively collaborates with law enforcement agencies, such as the Philippine National Police Anti-Cybercrime Group, reinforcing trust and security for its community.

Together with legislators and stakeholders, the app strives to protect Filipinos in an increasingly digital world.

Document Checklist

Ensure you have these documents and information handy when you start your registration:

- Mobile Number: Your UAE mobile number is required for account setup and verification.

- Government-Issued ID: Prepare a digital copy of your ID. You’ll need to upload this during the verification process.

- Personal Information: You will need to provide personal details such as your full name, date of birth, and address. Make sure all information is accurate and matches the details on your ID.

Eligibility and Registration

To be eligible for GCash Overseas, you must:

- Be a Filipino citizen and at least 18 years old.

- Have the latest version of the GCash app on your device

Step-by-Step GCash Registration in the UAE

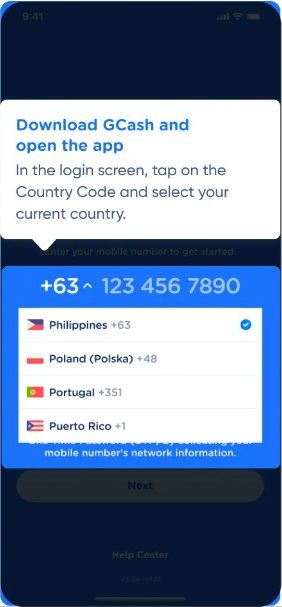

1. Download and Launch: First, download the app from your respective app store and select ‘UAE’ as your country. Enter your UAE mobile number to begin the setup.

2. Verification: You’ll receive a 6-digit OTP on your phone for verification. Enter this to proceed.

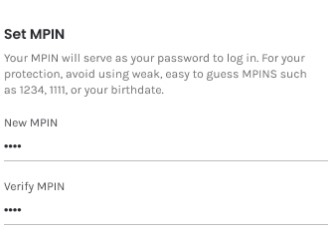

3. Set Up Your Account: Provide the necessary personal information and set your MPIN to secure your account.

4. Get Fully Verified: To use all the features of GCash Overseas, complete the full verification process. This step is important for accessing extended services.

Verification Process

After registering, you’ll need to complete the verification process to access all services. This usually involves:

- Uploading Your ID: You will be prompted to upload a clear photo of your ID.

- Selfie Verification: Some services may require a live selfie to ensure that the ID matches the person registering the account.

- Additional Information: Occasionally, additional information may be requested to complete your profile or enhance account security.

Why Full Verification Matters

Once your account is fully verified, the scope of what you can accomplish grows significantly.

Not only can you send money and pay bills, but you also have the convenience of cashing in through various international remittance partners.

Remember, the daily outgoing limit is PHP 100,000, and there’s no cap on monthly transactions, providing ample flexibility for managing large sums.

Available Services and Countries

GCash Overseas isn’t just limited to the UAE.

It spans several countries, including the United States, United Kingdom, Japan, Canada, and more.

Each region has tailored services, ensuring that whether you’re paying a bill in the Philippines or sending money to a relative, the app has you covered.

Here are some specific services available:

- Send Money: Available in all supported countries but restricted to sending only.

- PH Bank Transfers via Instapay: For when you need to transfer funds directly to Philippine bank accounts.

- Bill Payments and Mobile Loads: Stay up-to-date with your obligations in the Philippines without any hassle.

International Remittance Partners

Each country has specific partners that facilitate these transactions smoothly.

For instance, in the UAE, you can use Remitly, Western Union, and Instant Cash, among others.

These partnerships ensure that your money reaches its destination securely and quickly.

Tips for Using GCash in the UAE or Overseas

- Ensure You’re Fully Verified: GCash Overseas features are only available for fully verified accounts. This involves submitting valid IDs and undergoing facial recognition.

- Look for Alipay+ and GCash Logos: When making in-store payments, look for stores displaying the Alipay+ and GCash logos at the checkout counter. This indicates they accept GCash payments through QR codes.

- Utilize the GCash App for QR Transactions: There are two ways to pay using the app overseas. You can either scan the merchant’s QR code with your GCash app, or select “Pay Abroad with Alipay+” to have the merchant scan your GCash-generated QR code.

- Double-Check Transaction Details: Before confirming a payment, always review the amount carefully to avoid any errors.

- Be Mindful of Limits: There’s a daily outgoing limit of PHP 100,000 for GCash Overseas transactions. While there’s no monthly limit, it’s good practice to be aware of this restriction.

- Maintain a Secure Connection: Only use the app on a trusted and secure internet connection to protect your account information.

Video: GCASH Registration in DUBAI or ABROAD | Summer Bella

GCash offers a hassle-free registration process for users in Dubai or abroad.

By simply downloading the app, entering their mobile number, verifying through an authentication code, and setting up their MPIN, users can enjoy the benefits of this convenient mobile payment solution.

With the GCash app, users can easily manage their finances, make secure transactions, and enjoy a seamless digital payment experience wherever they are.

Conclusion

GCash Overseas is a testament to the flexibility and adaptability needed by Filipinos living abroad.

By simplifying the financial processes and linking you directly to services back home, it ensures you’re never too far away from your financial responsibilities and opportunities in the Philippines.

Whether you’re in the UAE or any other supported country, GCash Overseas has tailored solutions to meet your needs.