The House of Representatives is pushing to abolish the country’s travel tax, with lawmakers arguing that doing so could generate up to ₱22 billion in additional annual revenue.

Romero ‘Miro’ Quimbo said the government may initially lose around ₱7.5 billion per year if the travel tax is removed. However, he believes the loss would be temporary. According to Quimbo, increased travel activity could stimulate economic growth and raise income tax collections enough to offset the shortfall.

The proposal is part of House Bill No. 7443, authored by Sandro Marcos. The measure seeks to abolish the travel tax, which lawmakers say has “outlived its purpose.”

How the government expects to gain

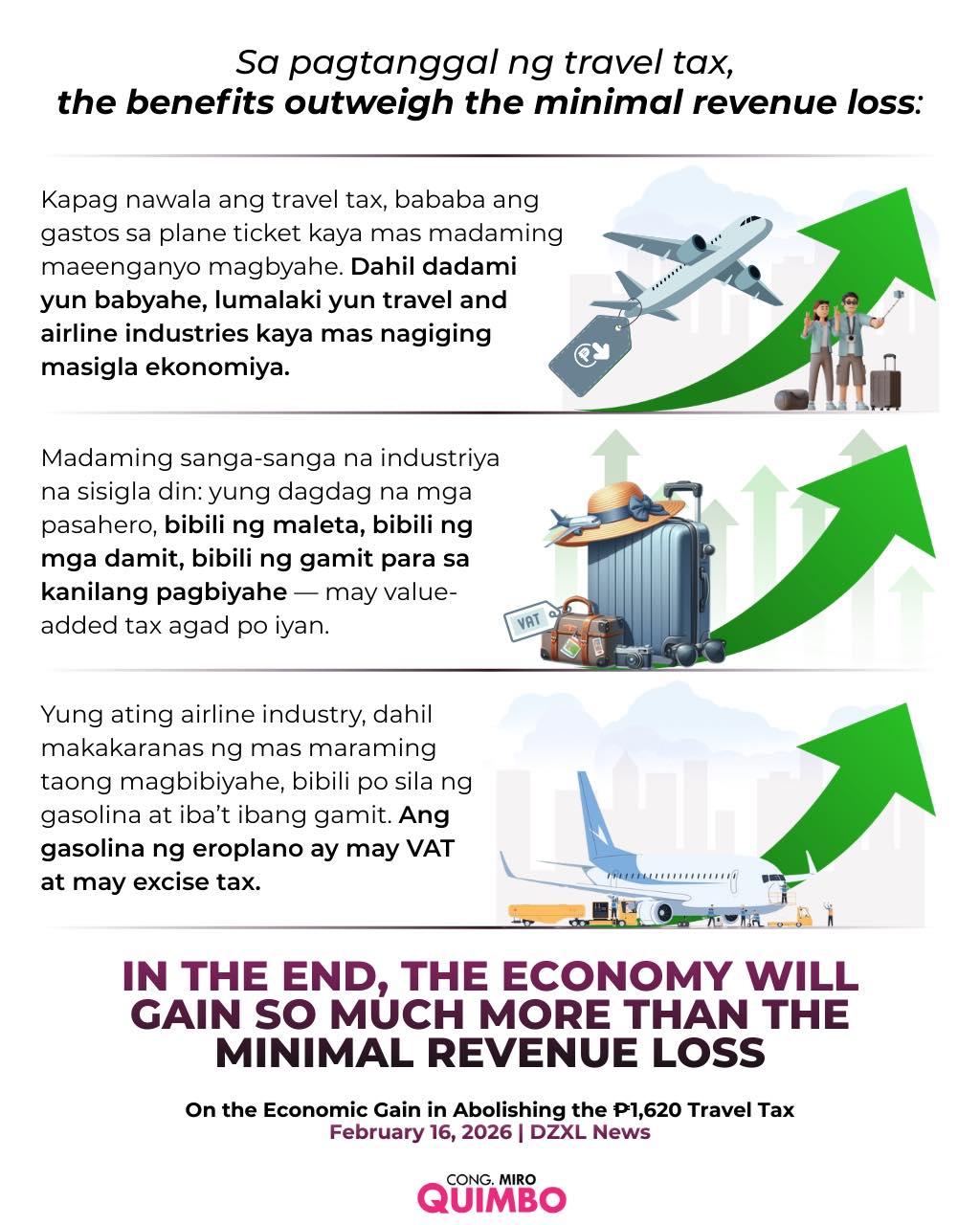

Quimbo explained that lowering travel costs would encourage more Filipinos to travel abroad. For example, airfare to nearby destinations such as Singapore or Bangkok often ranges from ₱8,000 to ₱9,000. Removing the travel tax could make trips more affordable, leading to higher passenger volumes.

More travelers would mean increased revenues for airlines, travel agencies, and other tourism-related businesses. As these companies earn more, they would pay more in income taxes.

Quimbo estimates that within 18 months of abolishing the tax, the resulting boost in economic activity could generate up to ₱22 billion in income tax revenue. This, he said, would more than cover the projected ₱7.5 billion annual loss from scrapping the travel tax.

Part of priority reforms

House Bill No. 7443 is listed as a priority measure of the Marcos administration. Lawmakers aim to transmit the bill to the Senate before Congress adjourns in June.

Travel industry groups have previously expressed support for reviewing or removing the travel tax, saying it adds to the cost burden of Filipino travelers.

The proposal is still pending in Congress. No changes have been implemented yet.

If passed, the removal of the travel tax could lower outbound travel costs and potentially reshape how the government collects revenue from the sector. For now, travelers should continue to follow existing rules and monitor updates as the bill moves through the legislative process.