The Central Bank of the UAE has begun testing the Middle East’s first facial and palm biometric payment system, allowing users to approve payments without using bank cards or mobile phones.

The pilot, announced on January 28, 2026, signals a shift toward fully digital and identity-based payments as part of the UAE’s wider push for cashless and contactless transactions.

Contents

Where the testing is taking place

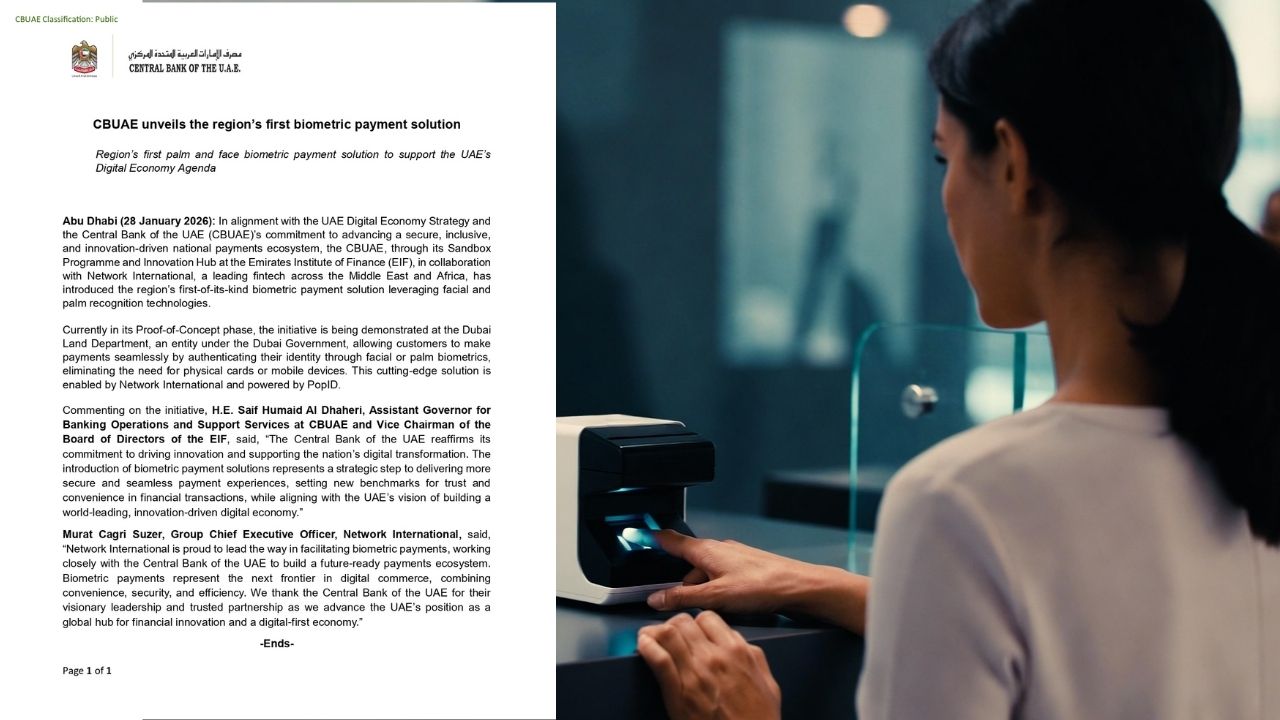

The biometric payment system is currently under proof-of-concept testing and is being showcased at the Dubai Land Department.

At the site, customers can complete payments by verifying their identity through facial recognition or palm scans, removing the need to present a physical card or smartphone during checkout.

Who is leading the initiative

The test is being conducted under the Central Bank’s Sandbox Program and Innovation Hub, based at the Emirates Institute of Finance.

The project is delivered in partnership with Network International, with biometric authentication technology provided by PopID.

Why the test matters

The Central Bank said the pilot supports the UAE Digital Economy Strategy by strengthening secure, inclusive, and innovation focused payment systems.

H.E. Saif Humaid Al Dhaheri, Assistant Governor for Banking Operations and Support Services at the Central Bank, said biometric payments enhance both security and ease of use, while helping set higher standards for trust in financial transactions.

Network International CEO Murat Cagri Suzer described biometric payments as the next stage of digital commerce, combining faster transactions with stronger fraud protection.

Biometric Payments as a Future

Although the pilot remains in a testing phase, it offers early insight into how everyday payments in the UAE may evolve.

Biometric payments suggest a future where carrying cards or phones may no longer be necessary, particularly in government services, banking, and high traffic locations.

Accuracy of personal records will become more important, as biometric systems rely on verified identity data. Residents may want to ensure their official documents and banking details are current across government and financial platforms.

Understanding how biometric authentication works will also matter. This includes how consent is given, how data is protected, and what safeguards are in place.

Adoption is expected to be gradual. Early use will likely stay within controlled locations before expanding to retail, transport, or wider public services. Monitoring pilot sites and participating institutions may offer early signals of where the technology will appear next.

Residents should continue watching for updates from the Central Bank of the UAE, as future announcements are expected to clarify timelines, sectors involved, and whether enrollment or opt in steps will be required once biometric payments move beyond testing.