There’s a new law passed by the UAE government Cabinet to help expats and residents who are struggling with financial cases in the country. The UAE Insolvency Law will take effect by January 2020. This is a really great help for those who are having difficulties managing their money especially due to unfortunate situations such as losing a job.

Also Read: How to Check if You Have a Travel Ban in Dubai

The UAE Cabinet has approved a federal law to regulate cases of insolvency of natural persons, aimed at enhancing the competitiveness of the UAE by ensuring the ease of doing business, creating favourable conditions for individuals facing financial difficulties and protecting those who are unable to pay their debts from going bankrupt.

UAE Cabinet Approves Insolvency Law for those Struggling in Financial Debt in UAE

This rule will help protect people who are honestly having difficulties to paying off their debts by placing them on a 3-year plan. During the 3 years, debtors will be given the opportunity to work and support their family while repaying the amount of debt. There will also be an expert appointed by the court who will assist in making a financial plan and coordinate with creditors so the debtor can pay their dues and avoid any prosecutions.

This is really helpful for those who are looking for assistance on how to manage their finances and to have room to breathe from compounding interests and penalties.

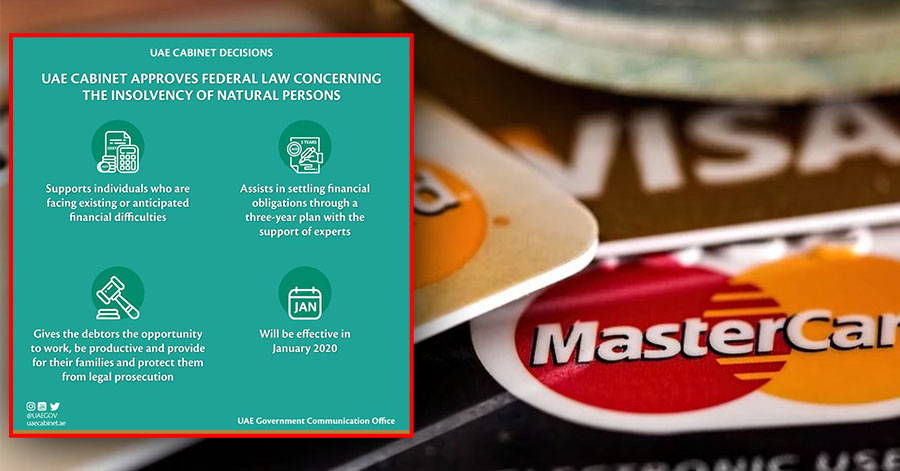

Below are some pointers and fast facts about the UAE Insolvency Law:

- Supports individuals who are facing existing or anticipated financial difficulties

- Assists in settling financial obligations through a three-year plan with the support of experts

- Gives the debtors the opportunity to work, be productive and provide for their families and protect them from legal prosecution.

- Will be effective in January 2020

Here’s the tweet from the UAE Cabinet Twitter account:

UAE Cabinet approves federal law concerning the insolvency of natural persons

#uaegov pic.twitter.com/3OwFpg67By— UAEGov (@uaegov) November 17, 2019

The law, which will enter into force in January 2020, will assist debtors in settling their financial obligations through one or more experts, to be appointed by the court. The experts will coordinate with the debtor and creditors to come up with a plan, lasting no longer than three-years, to settle the financial liabilities and fulfil all obligations stipulated in the plan. During this period, the debtor will be prevented from taking any loans until the court decides, upon the request of the expert, the debtor or any of the creditors, that the implementation of the plan has been accomplished.

The law also contains special provisions that contribute to the swift completion of legal procedures and reduces the fees charged for rescheduling and restructuring the debts, with a view towards finding a fair compromise for both creditors and debtors.

The law not only contributes to enhancing the credit-worthiness of the country, in the long run, and its future growth prospective, but also enhances the competitiveness and strength of its economy, thus ensuring an enabling environment that encourages entrepreneurship and provides favourable conditions for doing business.

The law, which complements existing financial laws, will contribute to increased transparency, in terms of civil debt repayment transactions, and will ultimately strengthen the UAE’s position as an ideal hub for investment, where the rights of all parties are guaranteed.