Renewing your Involuntary Loss of Employment (ILOE) insurance in the UAE guarantees continuous financial protection in case of unexpected job loss.

Join us as we explore the eligibility criteria, renewal steps via online portals and mobile apps, and key reminders about costs and deadlines.

Targeted at employed UAE residents with existing ILOE policies, it helps them maintain essential coverage and avoid penalties.

By following these instructions, individuals can seamlessly renew their ILOE insurance, securing their financial stability.

Contents

Understanding ILOE Insurance

This unemployment insurance guarantees that employees have financial protection if they lose their job unexpectedly.

This support is essential for managing daily expenses and finding new employment.

As of 2024, renewing your policy is essential to maintain this safety net.

Significance of ILOE Insurance Renewal

The renewal of ILOE (Involuntary Loss of Employment) policy is important for UAE residents to maintain continuous coverage, avoid penalties like policy cancellation and fines, and have access to the financial safety net it provides in case of unexpected job loss, as failing to renew before the expiry date will require re-subscribing through a new policy and waiting 12 months before being eligible for benefits, so renewing through the official ILOE website or mobile app is essential to uphold this insurance protection.

Eligibility Criteria for ILOE Insurance Renewal

To be eligible to renew your ILOE policy, you must meet the following criteria:

- Hold an existing ILOE policy with all premiums paid up to date.

- Be currently employed within the UAE.

Steps to Renew ILOE Insurance Online

Renewing your ILOE insurance can be done easily online through two methods provided by the Ministry of Human Resources and Emiratisation (MoHRE).

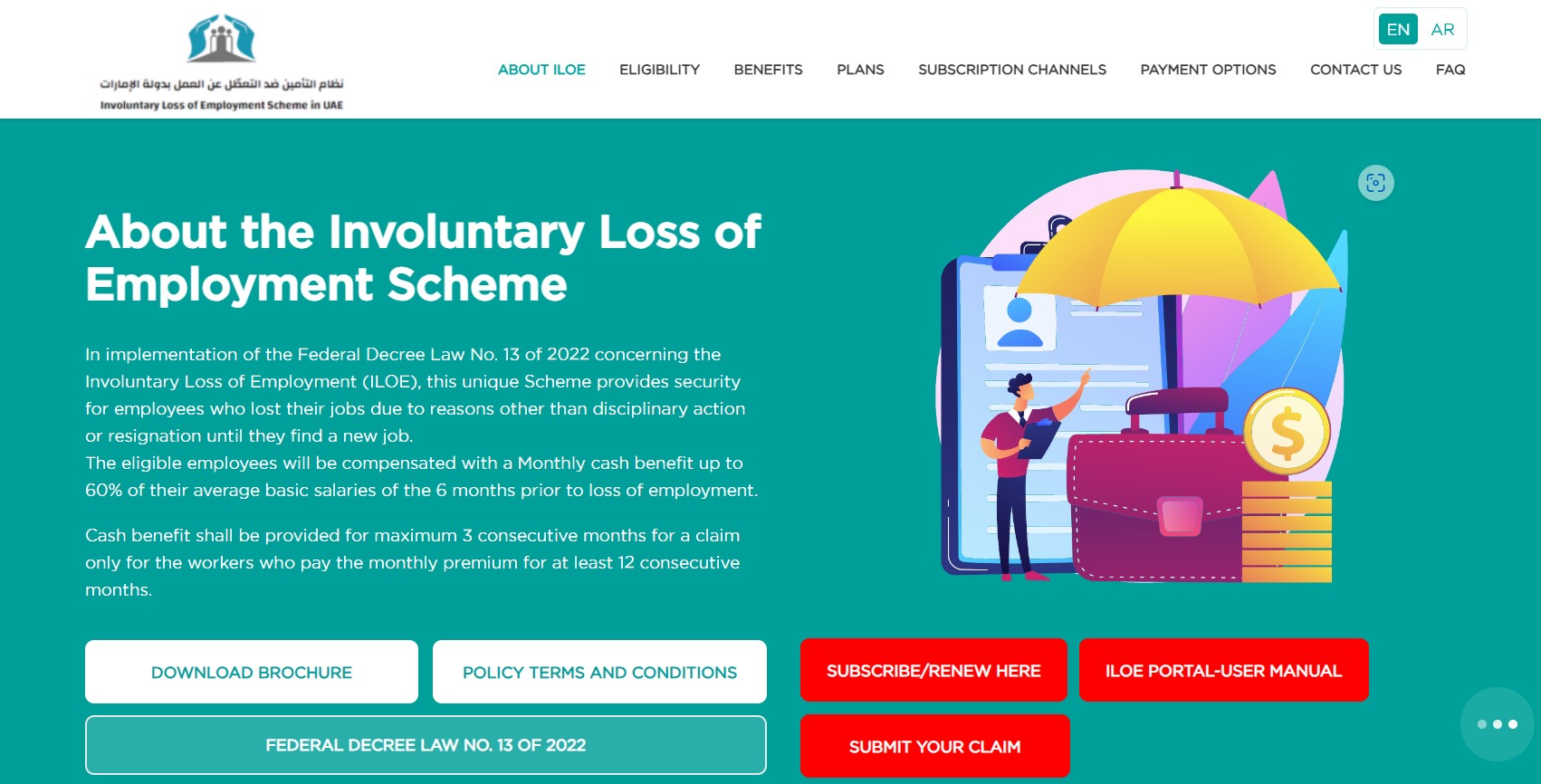

1. via the ILOE Portal

- Visit the official ILOE website at www.iloe.ae.

- Click on the red “Subscribe/Renew Here” button.

- Select your employment sector (private, public, or free zone).

- Enter your Emirates ID number and registered mobile number.

- Authenticate your login using the One-Time Password (OTP) sent to your mobile.

- Navigate to the “Renew” or “Subscription” section and follow the on-screen instructions to complete the renewal process.

- Make the payment using a debit card, credit card, or e-wallet.

2. via the ILOE Mobile App

- Download the “ILOE UAE” app from the Apple App Store or Google Play Store.

- Register if you’re a first-time user.

- Log in using your Emirates ID and registered mobile number.

- Go to the “Renew” or “Subscription” section within the app.

- Follow the in-app instructions to renew your policy and make the payment.

ILOE Insurance Renewal Costs

The cost of renewing your ILOE insurance depends on your basic salary.

For Salaries Less Than AED 16,000

If your basic salary is less than AED 16,000, you need to pay AED 5 per month.

This adds up to AED 60 per year.

For Salaries More Than AED 16,000

If your basic salary is more than AED 16,000, you must pay AED 10 monthly.

This totals AED 120 annually.

Make sure you know your salary bracket to determine your renewal cost.

Key Reminders for ILOE Renewal

Timely Renewal

Renew your ILOE policy before the expiry date to maintain continuous coverage.

Late renewals can result in penalties and gaps in coverage.

Official Channels

Always use the official MoHRE website and app for ILOE insurance management.

This safeguards your transactions as secure and legitimate.

Seek Assistance

If you need any assistance, reach out to ILOE through their official channels.

Customer support can help resolve any issues or answer questions you may have.

Benefits of ILOE Insurance

ILOE insurance provides peace of mind and financial stability during unemployment.

It helps cover living expenses while you search for new employment.

By renewing your policy, you ascertain that this significant support remains available to you.

Frequently Asked Questions

1. What happens if I miss the renewal deadline for my ILOE insurance?

If you miss the renewal deadline for your Involuntary Loss of Employment insurance in the UAE, your policy will be cancelled if premiums are unpaid for over 3 months, you’ll face fines for non-compliance, and you’ll have to re-subscribe through a new policy, losing your previous coverage history and benefits eligibility during the lapse period. To avoid these penalties and maintain continuous ILOE protection, it’s important to renew your policy before the expiry date through the official website or mobile app.

2. How can I check the status of my ILOE insurance renewal?

To track the status of your policy renewal in the UAE, log in to the official website at www.iloe.ae to view details like your policy number, start and end dates, category, and last payment; you may also receive SMS renewal reminders before expiry, and can renew online through the website or mobile app by selecting your sector, entering your Emirates ID and mobile, authenticating with OTP, and making payment, but missing the deadline can lead to policy cancellation, fines, and the need to re-subscribe, so it’s of utmost importance to renew before expiry to avoid penalties and maintain continuous coverage.

3. What is the period for submitting a claim for ILOE insurance? And what are the claim channels?

The insured must submit their claim within 30 days of termination.

Claims can be submitted through the ILOE portal, mobile app, call center at 600599555, or any other channels specified by the MOHRE in coordination with the Insurance Pool.

Video: Involuntary Loss of Employment insurance registration and renewal

The ILOE scheme, as per Federal Decree Law No. 13 of 2022, offers protection to employees losing jobs involuntarily, except for disciplinary reasons or resignation, ensuring financial security until reemployment. Employees can register for and renew this unique insurance for continued coverage during periods of job loss.

Conclusion

Renewing your ILOE insurance in the UAE is straightforward and essential for financial security.

Make sure you meet the eligibility criteria, follow the renewal steps carefully, and be mindful of the costs based on your salary.

By staying proactive about your policy renewal, you protect yourself from the uncertainties of job loss.

Use the official MoHRE resources to complete your renewal process smoothly and maintain continuous coverage.

With these steps, you can confidently renew your ILOE policy and secure your financial future in the UAE.