Are you planning to build your own house? Make some repairs and renovations? Or perhaps you are keen on building up your savings for retirement? If you are a Pag-IBIG Fund member, you can do any of these things simply by availing of their benefits and programs.

The Pag-IBIG Fund, also known as the Home Development Mutual Fund (HDMF), is a Philippine government corporation providing affordable house financing as well as savings programs for Filipinos. To members in the Philippines and abroad, it offers regular housing loans, calamity loans, multi-purpose loans, regular savings, and the MP2 savings program.

Contents

Benefits of Being a Pag-IBIG Member

In 2009, Republic Act No. 9679 (a.k.a. “Home Development Fund Law of 2009”) was passed, expanding Pag-IBIG Fund coverage to all Filipino workers regardless of status. These include self-employed persons and overseas Filipino workers (OFWs), along with Filipino immigrants and residents abroad, and even Filipinos who are naturalized in other countries.

If you are a Pag-IBIG Fund member, you can avail of the following benefits and programs:

1. Pag-IBIG Regular Savings

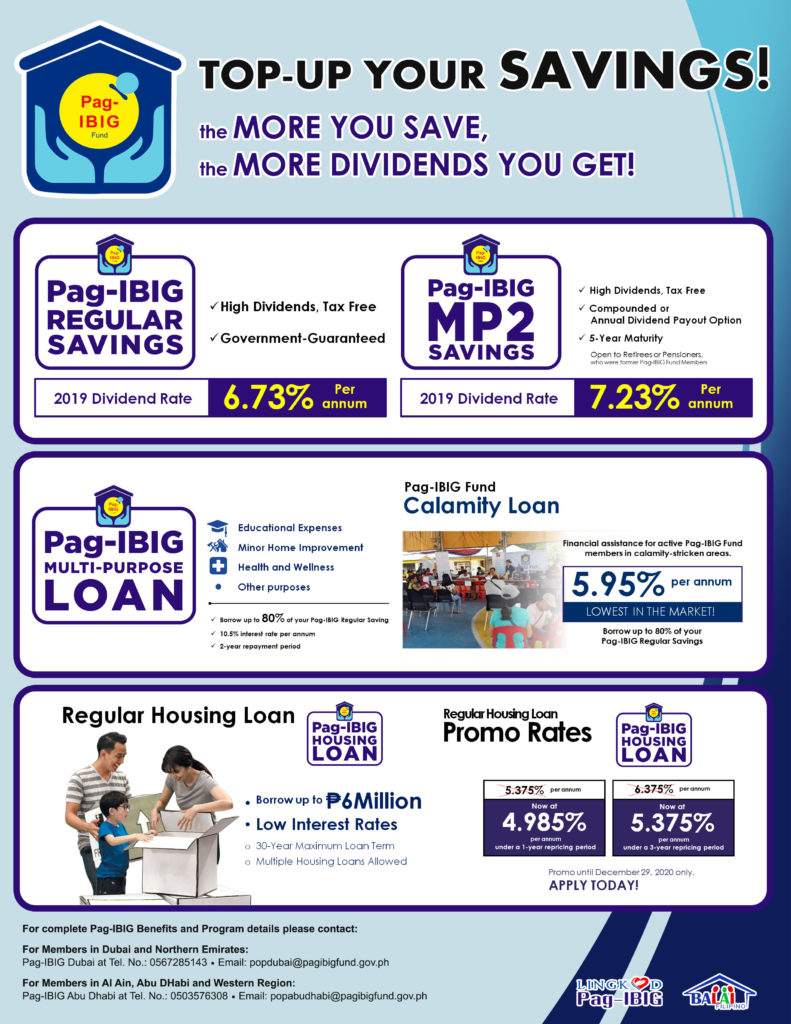

Pag-IBIG Regular Savings is a mandatory membership program that requires a minimum monthly contribution of PHP 100. As a member, your savings account could earn an annual interest rate that is much higher (7.61% as of 2017) than those in most banks nowadays. The higher you save each month, the bigger the savings and loan bracket you can apply for.

2. Pag-IBIG MP2 Savings

In addition to your regular savings, you can save more and earn higher dividends through the Pag-IBIG MP2 Savings program. For a minimum amount of PHP 500 per month, you can expect to earn tax-free dividends at a higher rate (average of 7.65% from 2016 to 2018) than that of the regular savings program. You can also opt for a one-time savings contribution instead of the monthly option.

Another great thing about this program is that it is open to pensioners and retirees who were former members of Pag-IBIG Fund. As for your savings and dividends, you can choose to withdraw these after the 5-year maturity period. Another option would be through an annual pay-out to be credited to your account with the Development Bank of the Philippines (DBP), Land Bank of the Philippines (LBP), or other banks accredited by Pag-IBIG Fund.

3. Pag-IBIG Housing Loan

If you are an active member with at least 24 months of savings, not older than 65, you can apply for a Pag-IBIG Housing Loan for the following purposes: (a) purchase of a residential lot; (b) purchase of a residential house and lot; (c) construction of a house; (d) improvement of a house; (e) refinancing of an existing housing loan; or (f) a combination of loan purposes.

Under this program, members can borrow up to PHP 6 million for a loan term of up to 30 years, depending on the pricing and period agreed upon by Pag-IBIG Fund and the member.

4. Pag-IBIG Fund Calamity Loan

If you are a member affected by calamities such as typhoons, earthquakes, and other natural disasters, you can apply for financial assistance through the Pag-IBIG Calamity Loan. With a low interest rate of just 5.95% per annum, this loan is payable within 24 months. All you have to do is accomplish a Calamity Loan Application Form, submit supporting documents, acquire an acknowledgement receipt, and receive your loan proceeds on the scheduled date.

5. Pag-IBIG Multi-Purpose Loan

The Pag-IBIG Fund Multi-Purpose Loan is offered to members with any urgent financial need, e.g. medication, children’s tuition fees, etc. You can borrow up to 80% of your Pag-IBIG Regular Savings, and the loan can be processed within just 2 days. Simply accomplish a Multi-Purpose Loan Application Form, submit the supporting documents, get your receipt, and receive your loan on the set date. The loan shall be paid over 24 months.

6. Pag-IBIG Loyalty Card

The Pag-IBIG Loyalty Card is basically a reward card that offers discounts on a various items: groceries, restaurant bills, medicine, hospital bills, tuition fees, and fuel expenses in more than 300 partner-establishments in the Philippines. It also serves as a cash card where members can receive their MP2 Savings dividends, Multi-Purpose Loan proceeds, and other benefits.

7. Virtual Pag-IBIG

Virtual Pag-IBIG is a new online portal where member can access Pag-IBIG Fund services anytime, anywhere. It also features a chat function, where an agent is always ready to answer your queries and concerns. Notably, here are the things you can do through this platform:

- Register as a member of Pag-IBIG Fund and acquire your permanent Membership ID (MID) number;

- Open a Pag-IBIG MP2 Savings account;

- Remit your Pag-IBIG Fund Regular Savings and MP2 Savings;

- View your records for Pag-IBIG Fund Regular Savings and MP2 Savings, including annual dividends earned;

- Schedule an appointment to submit documents for a Pag-IBIG Housing Loan application;

- Apply for a Pag-IBIG Calamity Loan or Multi-Purpose Loan;

- Pay for your Pag-IBIG Housing Loan, Calamity Loan, or Multi-Purpose Loan;

- Check the loan status of your Pag-IBIG Housing Loan, Calamity Loan, or Multi-Purpose Loan;

- View loan records, including payments made and the outstanding balance of your Pag-IBIG Housing Loan, Calamity Loan, or Multi-Purpose Loan;

- Apply for an interest-rate repricing of your Pag-IBIG Housing Loan;

- View the transaction history and account balance of your Pag-IBIG Loyalty Card; and

- Chat with a Pag-IBIG Fund service agent about your questions and concerns, anytime, anywhere.

In addition to the above features, the following services will be added to the Virtual Pag-IBIG portal soon:

- Application for the merging/consolidation of Member’s Records;

- Virtual Pag-IBIG for Employers, which will enable companies to endorse and track their employees’ loans online; and

- Virtual Pag-IBIG for Developers, which will enable partner-developers to validate if a member qualifies for a Housing Loan based on the necessary requirements.

Through these benefits and programs, all Pag-IBIG members — including OFWs in Dubai and other places around the world — can look forward to buying their own property, constructing their dream home, making house improvements, or building up their savings.

DISCLAIMER: The above details are presented for information-sharing purposes only. To learn more about the benefits and programs available to Pag-IBIG Fund members, please visit the Pag-IBIG Fund official website. Likewise, to know more about the government agency’s new online platform, please visit the Virtual Pag-IBIG official portal.

READ NEXT: How to Pay SSS Contributions as an OFW in the UAE