In today’s fast-paced and increasingly digital world, managing finances has become more convenient than ever before. One such example is the Social Security System (SSS) Disbursement Account Enrollment, which allows SSS members to receive their benefits directly from their chosen bank account. With this service, members no longer need to wait in long lines or worry about lost checks. Instead, they can simply enroll in their preferred bank account and have their benefits deposited automatically.

Also Read: How to Pay SSS Contributions as an OFW in the UAE

This is not only convenient but also secure, giving members peace of mind knowing that their funds are safe and accessible. In this article, we will explore the benefits of SSS Disbursement Account Enrollment, the enrollment process, and how it can help SSS members manage their finances with ease.

Contents

- What is SSS DAEM?

- Benefits of the SSS DAEM

- Where does this apply?

- How to Enroll

- How to enroll your bank or e-wallet in SSS DAEM

- Important Reminders on Disbursement Account Enrollment

- 1. Provide only valid and active bank account details or mobile numbers.

- 2. Avoid duplicate account/mobile numbers.

- 3. Double-check the details of your enrolled disbursement account.

- 4. For bank accounts, follow the guidelines below:

- 5. For Remittance Payout Companies (RTCs) and Cash Payout Outlets (CPOs), follow the guidelines below:

- 6. For E-Wallets, such as Paymaya, follow the guidelines below:

- Video: Tips & Guides – Pag-Enrol sa SSS Disbursement Account Enrollment Module (DAEM)

- Frequently Asked Questions

- 1. What is the Disbursement Account Enrollment Module (DAEM)?

- 2. What types of disbursement accounts can I enroll in DAEM?

- 3. How many bank accounts can I enroll in DAEM?

- 4. Can I use a joint bank account for my disbursement account?

- 5. What should I do if my bank account details have changed?

- 6. What should I do if I entered the wrong bank account details in DAEM?

- 7. Can I enroll a prepaid account in DAEM?

- 8. How long does it take for my disbursement account to be activated?

- Final Thoughts

What is SSS DAEM?

The SSS Disbursement Account Enrollment module (DAEM) is a convenient and secure system designed to provide SSS members with a hassle-free way of receiving their benefits. Through this system, members can enroll their bank accounts to receive their SSS benefits automatically, without the need for physical checks or lining up at SSS branches. The system not only saves time and effort but also ensures the safety and security of member’s funds. By enrolling in the SSS Disbursement Account Enrollment Module, members can manage their finances more efficiently, allowing them to focus on other important aspects of their lives.

The SSS Disbursement Account Enrollment Module was created to address the growing need for a more convenient and secure way of disbursing SSS benefits. In the past, SSS members had to personally claim their benefits through physical checks or cash at SSS branches. This process was not only time-consuming but also posed several security risks. There were instances of lost or stolen checks, which caused significant inconvenience and financial loss to members.

To address these issues, the SSS developed the Disbursement Account Enrollment Module, which allows members to enroll in their preferred bank account or e-wallets for direct deposit of their benefits. This system not only streamlines the disbursement process but also ensures the safety and security of members’ funds. The SSS Disbursement Account Enrollment system was created to provide a more efficient, convenient, and secure way for members to receive their benefits.

Benefits of the SSS DAEM

Convenience

With the Disbursement Account Enrollment program, SSS members no longer need to personally claim their benefits through SSS branches. Instead, their benefits are automatically deposited into their chosen bank account, making it more convenient and hassle-free.

Security

Enrolling in the Disbursement Account Enrollment program ensures the safety and security of members’ funds. This eliminates the risks of lost or stolen checks, which can cause significant financial losses and inconvenience.

Faster access to funds

By enrolling in the program, members can receive their benefits faster since they don’t have to wait for physical checks to arrive or to be processed at SSS branches.

Online transactions

The Disbursement Account Enrollment program allows members to make online transactions with their enrolled bank account, such as bills payment, fund transfers, and purchases, making banking more accessible.

Flexibility

Members can choose any bank that participates in the program and enroll multiple bank accounts for their benefits, giving them flexibility and control over their finances.

Where does this apply?

The SSS Disbursement Account Enrollment Module applies to all SSS members who are eligible to receive benefits, regardless of their location within the Philippines. This system is available to members who have an active SSS membership and have met the necessary contribution requirements.

Members can enroll their bank accounts or e-wallets through the SSS website or at any SSS branch nationwide. It’s important to note that members can only enroll one bank account at a time and should ensure that the account is valid and active.

Once enrolled, benefits such as maternity, sickness, retirement, and disability will be directly credited to the enrolled bank account or e-wallet on the scheduled date of disbursement.

Supported Banks

- Al-Amanah Islamic Bank

- AllBank (A Thrift Bank), Inc.

- Asia United Bank

- Australia and New Zealand Banking Group

- Bangko Mabuhay (A Rural Bank), Inc.

- Bangkok Bank Public Co.

- Bank of America

- Bank of China Unlimited

- Bank of Florida, Inc. (A Rural Bank)

- Bank of Commerce

- Bank of the Philippine Islands (BPI)

- BDO Network Bank, Inc. (A Rural Bank)

- BDO Unibank, Inc.

- Camalig Bank, Inc. (A Rural Bank)

- Cebuana Lhuillier Rural Bank, Inc.

- China Bank Savings

- China Banking Corporation

- CIMB Bank Philippines

- Citibank, N.A

- Country Builders Bank, Inc.

- CTBC Banking Corporation

- DCPay Philippines

- Deutsche Bank

- Development Bank of the Philippines (DBP)

- Dungganon Bank, Inc.

- East West Rural Bank, Inc.

- East-West Banking Corporation

- Equicom Savings Bank

- First Consolidated Bank

- Industrial Bank of Korea

- ING Bank, N.V

- JP Morgan Chase Bank

- KEB Hana Bank

- Land Bank of the Philippines

- Malayan Bank Savings and Mortgage Bank

- Maybank Philippines, Inc.

- Mega International Commercial Bank Co. Ltd.

- Metropolitan Bank and Trust Company (Metrobank)

- Mizuho Bank, Ltd.

- MUFG Bank, Ltd.

- Philippine Bank of Communications (PBCOM)

- Philippine Business Bank

- Philippine National Bank (PNB)

- Philippine Savings Bank (PSBank)

- Philippine Trust Company

- Philippine Veterans Bank

- Producers Savings Bank

- Rang-ay Bank (A Rural Bank), Inc.

- Rizal Commercial Banking Corporation (RCBC)

- Robinsons Bank Corporation

- Rural Bank of Guinobatan

- Security Bank Corporation

- Shinhan Bank

- Standard Chartered Bank

- Sterling Bank of Asia

- Sumitomo Mitsui Banking Corporation

- The Hongkong & Shanghai Banking Corporation (HSBC)

- Union Bank of the Philippines

- United Coconut Planters Bank (UCPB)

- United Overseas Bank (Philippines)

- Wealth Development Bank

- Yuanta Savings Bank

Supported e-Wallets

Aside from banks, here are some e-wallets that are also supported.

- GCash

- PayMaya

- Coins.PH

- CBP Cash Padala Thru M Lhuillier

How to Enroll

Requirements

If you are planning to enroll in the SSS Disbursement Account Enrollment system, there are certain requirements that you need to prepare. The first requirement is proof of account, which will vary depending on whether you choose to enroll a bank or e-wallet account.

For Banks

If you choose to enroll a bank account, you may upload any of the following:

- ATM card with Account No. and Name, Bank Certificate (must be issued within the current year),

- Foreign remittance receipt,

- Passbook,

- Screenshot of online or mobile banking account, and

- Validated deposit slip.

Note: The file size must not exceed 3MB, and it must be in JPG or PDF file format only.

For e-Wallets

If you choose to enroll an e-wallet account, you must upload a screenshot of your mobile app account, where your name and mobile number are visible.

In addition to proof of account, you must also prepare a valid ID. The accepted IDs include:

- Unified Multi-Purpose Identification (UMID) Card,

- Social Security (SS) Card,

- Philippine Identification (PhilID) Card,

- and many more.

Lastly, you must also prepare a selfie holding your valid ID and proof of account, with proper attire and no face accessories.

By preparing these requirements, you can easily enroll in the SSS Disbursement Account Enrollment system and enjoy the convenience and security it offers.

How to enroll your bank or e-wallet in SSS DAEM

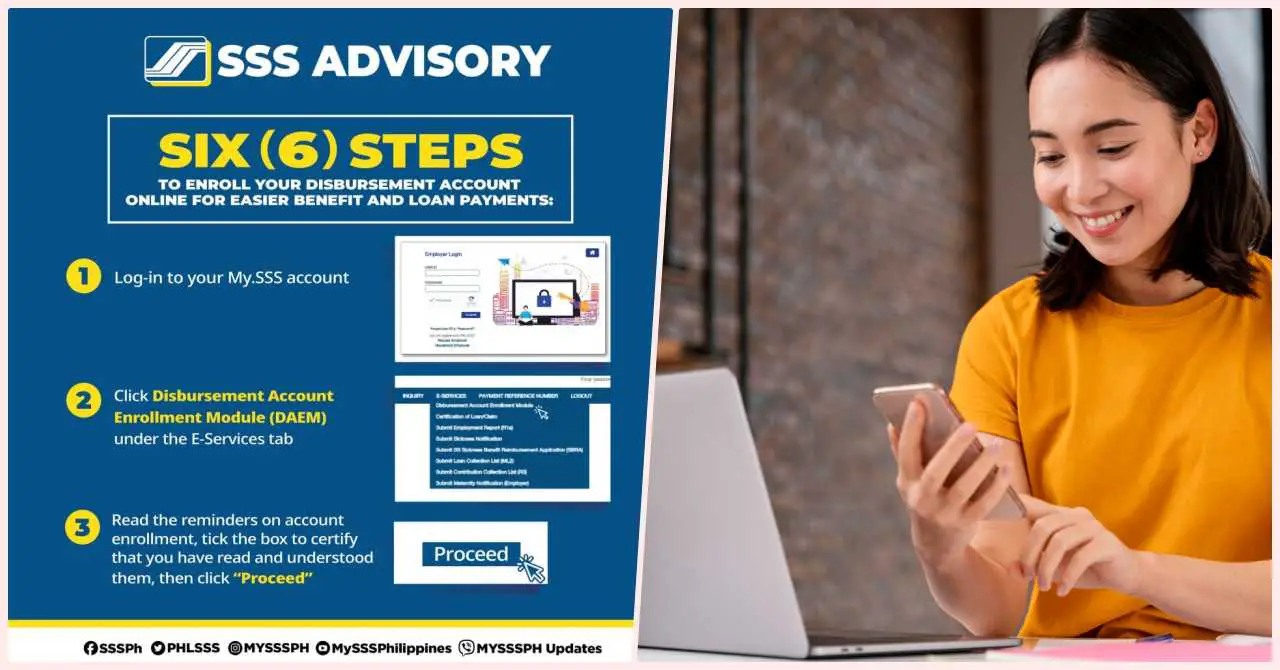

Enrolling your preferred disbursement account in SSS DAEM is a simple process that requires you to log in to your My.SSS account and follow a few steps. Here is a guide to help you get started.

Step 1: Login to My.SSS. Visit the official website of SSS and login to your account.

Step 2: Click Disbursement Account Module (DAEM) under the E-Services tab. Select the first sub-menu item under DAEM.

Step 3: Click Proceed once you read the reminders. Read through the reminders to help you enroll your disbursement account and click Proceed.

Step 4: Choose your preferred bank or e-wallet. Select either Bank or E-Wallet/RTC/CPO and choose your preferred bank or e-wallet from the drop-down list. Enter your account number or mobile number for e-wallet.

Step 5: Attach your supporting documents including the Proof of Account, Valid ID, and Selfie Attach readable colored image/s in JPG or PDF format. Maximum file size is 3MB and filename should not contain special characters.

Step 6: Accept the Data Collection Usage Clause and click Enroll. Double-check your information and accept the Data Collection Clause and click Enroll.

Step 7: Check your email inbox for Confirmation Notice from SSS Once you’ve submitted your SSS DAEM enrollment, you’ll receive an automated email from SSS confirming your transaction. Wait for a couple of days for SSS to approve your online transaction. Once approved, you’ll now see your disbursement account enrolled in your My.SSS account in DAEM.

Important Reminders on Disbursement Account Enrollment

If you are an SSS member and want to enroll your bank account or mobile number for benefit or loan disbursement, there are some important reminders you need to keep in mind. These reminders will help ensure that your enrollment process goes smoothly and that you receive your benefit proceeds on time.

1. Provide only valid and active bank account details or mobile numbers.

Make sure that the bank account or mobile number you provide is active and valid. Do not use closed, dormant, or frozen accounts, dollar accounts, joint accounts, time-deposit accounts, prepaid accounts, or accounts with restrictions. If you are using Paymaya/Gcash, double-check your mobile number digits to avoid errors.

Also, make sure that the registered name in your bank account is the same as your registered name in your SSS. If there is a mismatch, the disbursement may not go through.

If you choose a different disbursing bank from your own bank account, make sure to double-check the details to avoid errors.

2. Avoid duplicate account/mobile numbers.

Duplicate accounts or mobile numbers will be rejected, so make sure that you use a unique account or mobile number that has not been used by another SSS member. If you want to use your spouse’s Gcash account, for example, make sure that he or she has not used it as an SSS disbursement account before.

It is recommended that you register or make your own disbursement account to avoid problems with your benefit or loan disbursement.

3. Double-check the details of your enrolled disbursement account.

Errors in the details of your enrolled disbursement account may result in the non-crediting of your benefit proceeds. To avoid this, double-check the details of your enrolled disbursement account before submitting them.

If there are errors, re-crediting of the benefit amount may take up to 30 days processing time upon correction of erroneous account details.

4. For bank accounts, follow the guidelines below:

- Employers or their authorized personnel may enroll only one PESONet-participating bank account, which may be used for all its branches and subsidiaries.

- Employed and individually-paying members may enroll up to three active bank accounts but must nominate only one of these accounts for benefit or loan disbursement.

- Enter the bank account number and not the ATM card number. Please check the correct bank account number from your disbursing bank.

- Bank account numbers should be written as a continuous string of numbers and do not include the dash and other symbols in between.

5. For Remittance Payout Companies (RTCs) and Cash Payout Outlets (CPOs), follow the guidelines below:

- The SSS will send the reference number needed to claim the benefit proceeds via text message, so make sure that your mobile number is correct and active.

- Encode mobile numbers in their 11-digit format (e.g., 0917234567), without the +63, or dash (-) or any non-numeric characters.

- The maximum allowable amount for disbursement thru RTC/CPO is Php100,000.

- RTCs/CPOs, such as MLhuiller, will charge transaction fees based on their prevailing rates.

- In case of a wrong mobile number encoded in the DAEM or a lost mobile phone (i.e., lost reference number), re-crediting of the benefit amount to the correct or new mobile number may take up to 30 days processing time upon receipt of request.

6. For E-Wallets, such as Paymaya, follow the guidelines below:

- Make sure that your account is upgraded so that it can receive the full amount of proceeds beyond the usual limit. An upgraded account has a green beside the owner’s profile in the PayMaya app.

Video: Tips & Guides – Pag-Enrol sa SSS Disbursement Account Enrollment Module (DAEM)

In this video, the vlogger discusses the process of enrolling your chosen disbursement account in the Disbursement Account Enrollment Module (DAEM) of the Social Security System (SSS). She explains why it is important to provide only valid and active bank account details or mobile numbers, and what to avoid when selecting a disbursement account. She also shares some reminders on how to avoid errors in the details of your enrolled disbursement account, and what to do if you encounter issues with your chosen disbursement account. If you’re an SSS member looking to receive your benefit and loan proceeds, as well as refunds, this video is for you. Watch now and learn how to enroll your disbursement account in the DAEM.

Frequently Asked Questions

1. What is the Disbursement Account Enrollment Module (DAEM)?

The DAEM is an online system developed by the Social Security System (SSS) that allows members to enroll their chosen bank account, e-wallet, or remittance payout company as their disbursement account for their SSS benefit and loan proceeds.

2. What types of disbursement accounts can I enroll in DAEM?

You can enroll a PESONet-participating bank account, up to three (3) active bank accounts, e-wallets such as Paymaya, and remittance payout companies (RTC) or cash payout outlets (CPO) such as MLhuiller.

3. How many bank accounts can I enroll in DAEM?

Employers or their authorized personnel may enroll in one (1) PESONet-participating bank account, which may be used for all its branches and subsidiaries. Meanwhile, employed and individually paying members may enroll in up to three (3) active bank accounts, but must nominate only one of these accounts for benefit or loan disbursement.

4. Can I use a joint bank account for my disbursement account?

No, you cannot use a joint bank account as your disbursement account. Only bank accounts that are named after you and are solely owned by you are allowed.

5. What should I do if my bank account details have changed?

If your bank account details have changed, you must update your enrolled disbursement account in DAEM to avoid any problems with your benefit or loan disbursement.

6. What should I do if I entered the wrong bank account details in DAEM?

If you entered the wrong bank account details in DAEM, you must immediately correct the erroneous details. Errors in the details of your enrolled disbursement account may result in the non-crediting of your benefit proceeds, and re-crediting of the benefit amount may take up to 30 days processing time.

7. Can I enroll a prepaid account in DAEM?

No, you cannot enroll a prepaid account in DAEM. Only valid and active bank accounts or mobile numbers are allowed.

8. How long does it take for my disbursement account to be activated?

Your disbursement account will be activated within 3 to 5 business days upon successful enrollment in DAEM.

Final Thoughts

In conclusion, the SSS Disbursement Account Enrollment is a great example of how technology can make our lives easier. This service streamlines the process of receiving SSS benefits and loans, providing you with a faster and more secure way of managing your finances.

By enrolling in your preferred bank account, you can avoid the hassle of waiting in lines or worrying about lost checks. You can have peace of mind knowing that your funds are safe and accessible. With the continuous development of technology, we can expect more convenient and efficient financial services from the SSS in the future.